Today we’ll be looking into variable annuities. Variable annuities first appeared in the 1950’s as a way to help combat spending power loss in fixed annuities. Today, they are still used—for the same reason! Let’s dive in!

Today, we will dive into a deeper analysis of fixed annuities. These annuities were the original type of annuity and were used for centuries for funding wars, retirement funds, and taking care of soldier’s families while they were gone. Currently, they are still used by many as a form of fixed retirement income. Let’s get into the details!

Topics: Annuities

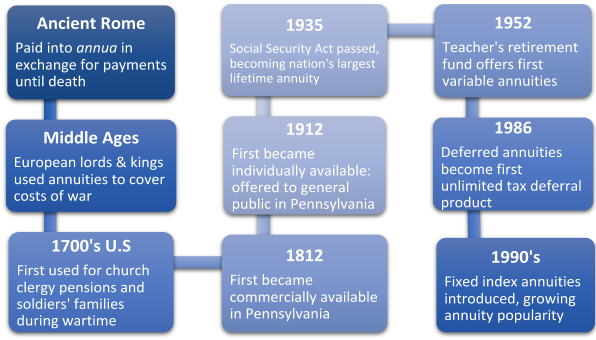

Welcome back to our series about annuities! This time, we will be diving a little deeper into the basics of annuities. We will look at how annuities work and some important terms to concentrate on when thinking about an annuity or examining an annuity contract. First, let’s take a look at the history of annuities. They’ve been around for a very long time and have evolved over the many years.

Topics: Annuities

Annuities 101: Understanding the Misconceptions

Annuities can be some of the more complex and misunderstood financial products out there. Just start typing the word “annuity” into your search bar and look at the 33 million articles it presents. “Why Annuities are a Bad Idea for Almost Everyone” and “Despite What You’ve Heard, Annuities Aren’t All Bad” were the two of the articles found on Google recently for an annuities search. And so, the contradictions begin.

Topics: Annuities

Now that we have gone over how Creekmur Wealth Advisors approaches, analyzes, and acts on investing, let’s put it all together. In this part, we will examine an individual case study; we will look at one exchange-traded fund and explain how we make an investing decision based on those three steps of analysis. Today, we will be diving deep into the ETF named CIBR!

Topics: Investing

Creekmur Investing 203: Investing Actions

Now that you’ve had a glimpse at our process for bringing in new investments, it is time to look at a more continuous investing responsibility of our firm: managing our current portfolios. This involves using the various investing actions that can be taken to continuously update and tweak our current holdings. This helps to ensure that our models reflect the current markets and maintain our goal of outperformance. Let’s take a look at these options:

Topics: Investing

Creekmur Investing 202: Tools for Analysis

How an individual or advisor conducts an analysis for a potential investment is one of the largest contributors to the long-term success of that particular investment. If someone has a well thought out analysis process, the odds of investing success could greatly increase.

Topics: Investing

Creekmur Investing 201: Investing Schools of Thought

In this next section of our investing series, we will be examining the philosophy side of investing. There are essentially two schools of thought: fundamental and technical. These two approaches to investing are often placed on opposite ends of the spectrum, but most investors fall somewhere in between the two schools. Let’s dive in!

Topics: Investing

In this series, Creekmur Wealth wants to give you a better understanding of how we go about investing for our clients: what our thought process is, what tools we use, and, what our options are for your products. But first, allow us to introduce ourselves to those of you who do not know us yet.

Topics: Investing

Not making a move may not always be the best move to make.

A decision not made may have financial consequences. Sometimes, we fall prey to a kind of money paralysis, in which financial indecision is regarded as a form of “safety.”

Topics: Retirement