At Creekmur Wealth Advisors we have had the unique opportunity over the last 30 years to partner with thousands of families from around the country and help them achieve their goals and dreams. There is nothing more rewarding than working with a client for years, or even decades, and seeing how these individuals use the tool that is money to live out their ideal lifestyle.

Over the years, we have found a wide disparity of outcomes between those that utilize a true financial plan and those that do not. Those with a plan can navigate the market or economic storms that will inevitably come and have peace of mind throughout that difficult time. Those without a plan often struggle to make the right decision or end up making an emotional decision that is not based on data that ultimately hurts them. Those with a plan usually end up achieving their primary goal and then have the resources to pursue other passions or dreams that they have. Those without a plan frequently don’t recognize how much potential their finances could afford them.

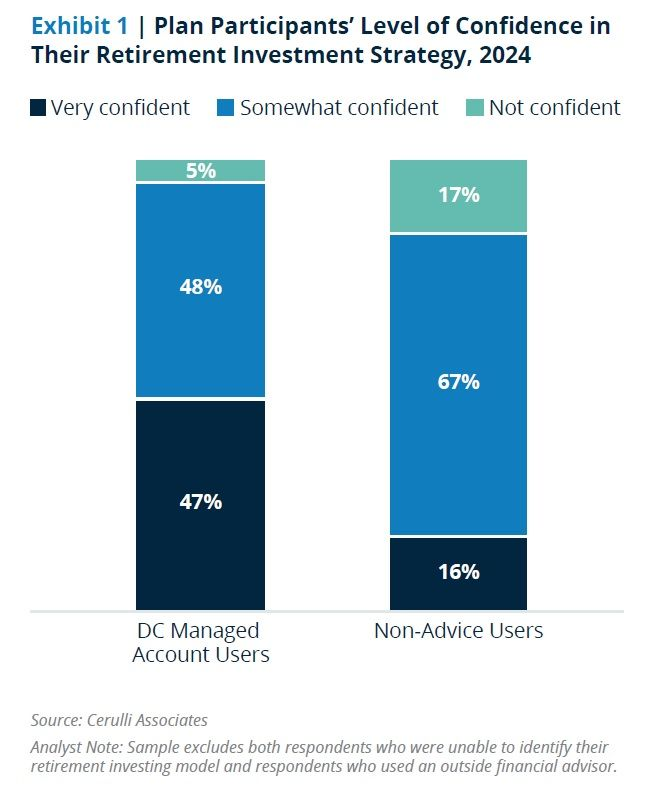

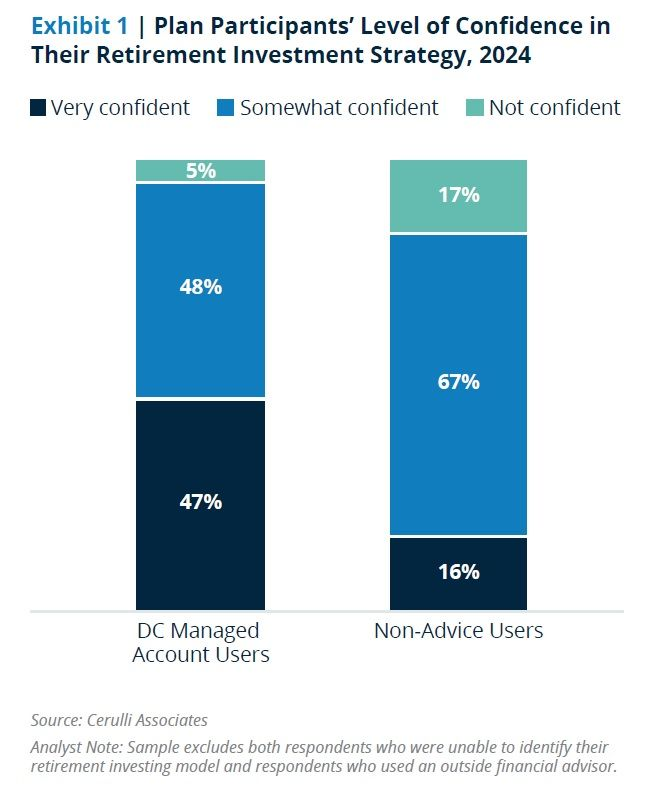

I recently came across a study from Cerulli Associates that dove into this very topic:

These results somewhat surprised me at first, but after taking some time to consider our own experience working with clients, these results actually appeared to be quite accurate. Whether you are building a home, taking a vacation, or planning for your financial future having a clearly defined goal and structured plan to help you achieve that goal ensures that you can proceed with confidence and peace of mind. There will always be another market crash, economic recession, or even drastic changes in one’s personal life. Our desire at Creekmur Wealth is to ensure that our clients do not have to worry about money during any of those challenging moments. That is why we have created the Retirement Blueprint.

The Retirement Blueprint is a customized retirement plan that seeks to ensure that the four pillars of your retirement – Income, Investments, Taxes, and Legacy - have a clearly defined plan in place to address each risk that could stand in the way of you achieving your goals. The below link goes into greater detail on the exact planning work that goes into building each of these pillars:

CWA Blueprint Process

Whenever a Blueprint is completed that does not mean the work stops. One constant in our world is change, and as change occurs your Blueprint needs to evolve with it. That is why we meet with our clients throughout the year to review progress towards their goals and address any changes in the world around us, whether that be a market, tax, or lifestage change. Below are a couple of conversations that our Founder & CEO John Creekmur had with our clients regarding how life changes can lead to a need to evolve your Retirement Blueprint:

Studies have shown that the vast majority of Americans do not have a written retirement plan. Which is why our team of qualified and credentialed professionals live every day striving to help ensure that no individual or family is without a plan. If you do not have a retirement income plan, or maybe have concerns about your current plan, I would strongly encourage you to reach out to our team. Our advisors and CFP Professionals are standing by to help you achieve your goals and dreams.

The information presented is not investment advice - it is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser when making investment decisions.

Read More

Topics:

Financial Planning,

Investment Portfolio,

market risks,

market volatility,

Planning,

Retirement,

S&P 500,

Stock Market,

Stagflation

Last week saw critical economic data released concerning the current trends for inflation and economic growth. After the data was released a number of talking heads and media reports began utilizing a phrase called “Stagflation” based on the trends that are beginning to emerge in the economic data. We wanted to write a brief summary of the history and meaning of Stagflation, as well as digging into some of the steps that we are taking to help protect our clients and ensuring that each of you continue on your path towards achieving those major financial goals that you have.

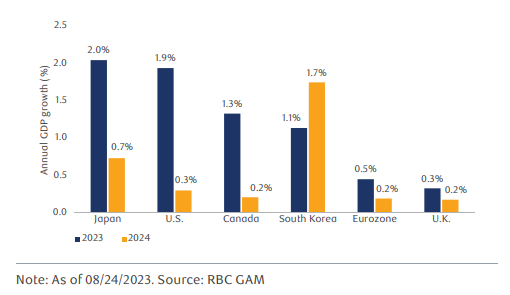

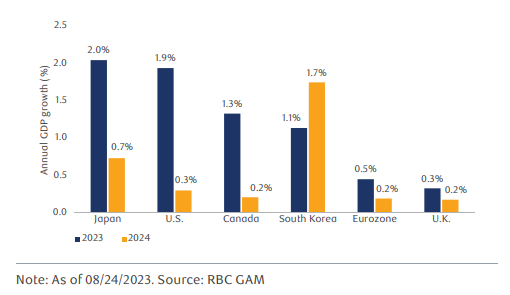

Stagflation is characterized as slow economic GDP growth, rising or high unemployment, and rising inflation. Last week’s data was the first time that this trend emerged since the 1970s, however, we will need to see multiple months of the same data trends to truly state we are in a stagflationary environment. Gross Domestic Product increased at a pace of 1.6% annualized for the January – March 2024 time period, which was well below the estimated growth rate of 2.4% for that time period. Additionally, the Personal Consumption Index, which is a key inflation metric, increased at a 3.4% annualized rate for the quarter, which was higher than anticipated. Currently, unemployment is not rising at a rate that is higher than anticipated, which is one area of relief. That said, falling economic growth coupled with rising inflation is one of the first warning signs that we could be entering into a stagflationary environment. Expectations for Global GDP show a strong belief that economic growth will strongly decelerate this year:

There is still time for Central Banks around the world to engineer a “Soft Landing”, which would entail no recession, strong employment, and positive economic growth. While there is still time for this landing to occur, the current data shows that Central Banks worldwide will have an increasingly tough time making that happen.

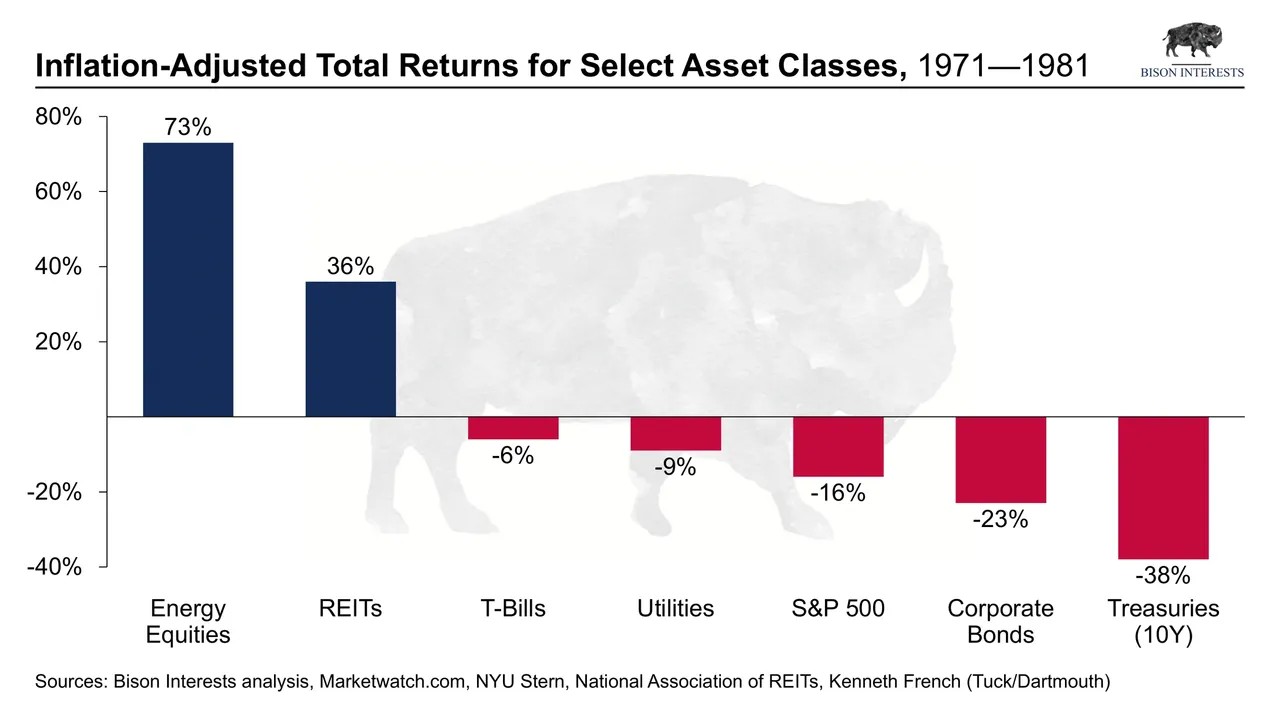

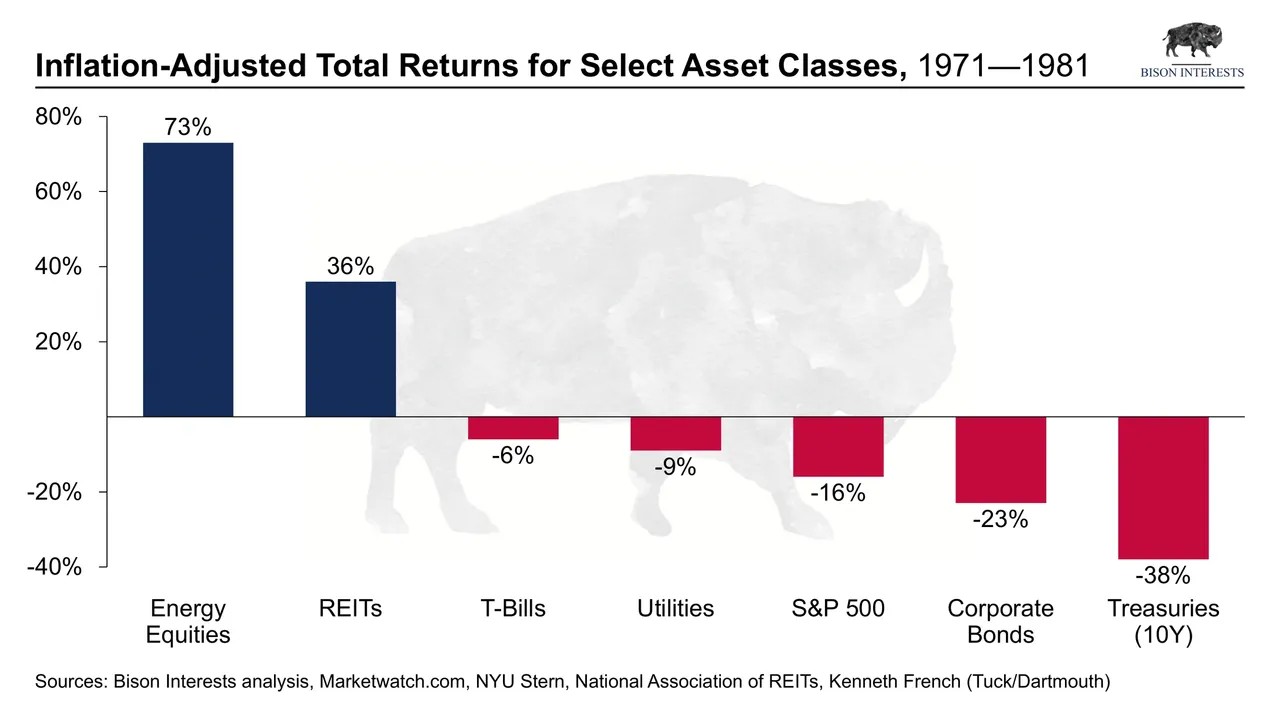

The most recent period of Stagflation occurred during the 1970s. During that decade the average inflation rate was 7.4% annually, there was significant scarcity of key commodities such as oil, unemployment was high, and consumer confidence was very low. Additionally, the S&P 500 compounded at 5.9% a year during the decade, which trailed the average inflation rate of 7.4% by 1.6. While there are similarities between today and the 1970s, there are still a number of key differences. Unemployment is currently low, consumer confidence is still high, and commodity production is much less volatile. The biggest difference between today and the 1970s is the impact of technology on our daily lives. Technology advancements over the last 20 years have helped the global economy to experience a deflationary economic environment during that time. Technological advancements lead to more efficiency, which decreases costs across the board, and in turn leads to a strong economy or stock market. It is important to study history in order to better understand the potential outcomes and necessary adjustments needed in today’s world, but we must also recognize that our world today is considerably different than it was 50 years ago.

The most frequent question we have received from our clients is how do we ensure our financial plan or retirement is not negatively impacted if we do have an extended stagflationary environment? Below are three key areas we encourage everyone to dig into in their personal financial life:

- Have a Data-Tested Plan – Each of our clients has a customized retirement income plan that is stress tested using different periods of economic distress to determine whether or not they will be able to achieve their goals. One of the key periods that we have been stress testing all retirement income plans we have built for is the 1970s. We have been doing this over the course of the last few years as we anticipated there was a strong chance of stagflation potentially returning. On average we have seen that the majority of our client’s current plans are very strong and do not see reductions to their spending capacity in retirement. If you do not have a Data Tested Retirement Income Plan this is the first critical step you need to take to ensure you are protected from the potential of Stagflation.

- Review Portfolio Asset Allocation – The 1970s saw the S&P 500 trail core inflation by 1.6% over the full decade. A major difference in many investors' portfolios between the ‘70s and today is the proliferation of index funds being utilized. During strong bull markets, the utilization of index funds is a great way to ensure that your portfolio experiences strong returns. However, periods of extreme market and economic volatility is a time period where investment flexibility is key to having returns that keep pace with or exceed inflation. Below is a great chart that details how various sectors performed during the 1970s:

- It is important to remember that history rhymes, it does not repeat. What areas of the markets performed well in the 1970s will likely have strong potential for outperformance again, however the world today is exceptionally different. Technology has increased economic efficiency, which leads to a deflationary environment, and has become a key component of our daily lives, which has led to increasingly well run and capitalized companies that can continue to maintain strong stock growth.

- That said, in client portfolios we have already over weighted to equities in the energy, industrial, and commodity sectors. Additionally, we are closely tracking how the largest tech companies are performing as a business on a quarterly basis, so far these companies have continued to have impressive revenue growth while closely monitoring or decreasing the expense side of their balance sheet. This is a great sign that these companies are taking the necessary steps to protect shareholders from the risks of Stagflation. We will likely continue to adjust in client portfolios if data that is released in the coming months shows a continuing stagflationary trend emerging.

- We are encouraging every client we speak with to have a Portfolio Stress Test conducted. We utilize a software tool that looks at how your portfolio would have performed during the 1970s as it is currently invested. What we have seen across the board are portfolios that are significantly underweight to the Energy and Industrial sectors. This is a function of the incredible, technology-driven bull market that we have been in for the last 15 years. This does not mean that you should invest fully into Energy and Industrials, with nothing in Technology. This means that you need to ensure that you have a well-diversified portfolio that can be adjusted as more data and trends emerge.

- Maintain Flexibility – During periods of economic uncertainty it is key that each of us has flexibility in our financial lives to adjust as trends emerge. Flexibility comes in many forms. For example, having a minimum of 6 months’ worth of expenses in cash is a key cornerstone that allows you to weather a wide variety of expenses that may arise. Paying down debt as much as possible to increase monthly cash flow is another great step to take. But most importantly, having a customized plan in place that is data tested, but also flexible to allow for the readjustment of your plan is important to be able to stay in front of the changes that are likely coming in the months ahead. If you do not have a Retirement Income Plan or have not reviewed your plan in a while, I would strongly encourage you to reach out to our time to schedule time to ensure your plan is data tested and has these risks addressed.

Understanding history and data is critical to ensuring that your plans for the years ahead are not thrown off. We believe that there are steps that every individual can take to ensure that you are able to live out the life you envision for your family and yourself. Our team has compiled a great lineup of resources and tools to help our clients address these concerns, I would encourage you to reach out to schedule time with your advisor if you have any questions or would like to see how your current plans are impacted by the emerging Stagflationary trend.

The information presented is not investment advice - it is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser when making investment decisions.

Read More

Topics:

Financial Planning,

Investment Portfolio,

market risks,

market volatility,

Planning,

Retirement,

S&P 500,

Stock Market,

Stagflation

Some things you might consider before saying goodbye to 2021.

Preparing for retirement just got a little more financial wiggle room. In November, the Internal Revenue Service (IRS) announced new contribution limits for 2022.

Staying put for 2022 are traditional Individual Retirement Accounts (IRAs), with the limit remaining at $6,000. The catch-up contribution for traditional IRAs remains $1,000 as well.1

For workplace retirement accounts (i.e. 401(k), 403(b), amongst others), the contribution limit rises $1,000 to $20,500. Catch-up contributions remain at $6,500.1

Eligibility for Roth IRA contributions has increased, as well. These have bumped up to $129,000 to $144,000 for single filers and heads of households, and $204,000 to $214,000 for those filing jointly as married couples.1

Another increase was for SIMPLE IRA Plans (SIMPLE is an acronym for Savings Incentive Match Plan for Employees), which increases from $13,500 to $14,000.1

If these increases apply to your retirement strategy, a financial professional may be able to help make some adjustments to your contributions.

Read More

Topics:

Uncategorized,

Financial Planning,

Investing,

Planning,

Retirement

Some things you might consider before saying goodbye to 2021

What has changed for you in 2021? For some, this year has been as complicated as learning a new dance. Did you start a new job or leave a job behind? That’s one step. Did you retire? There’s another step. If notable changes occurred in your personal or professional life, then you may want to review your finances before this year ends and 2022 begins. Proving that you have all the right moves in 2021 might put you in a better position to tango with 2022.

Read More

Topics:

Uncategorized,

Financial Planning,

Investing,

Planning,

Retirement

Frothy, Bubbly, Foamy. . . and we're not talking about cappuccino!

Read More

Topics:

Financial Planning,

Investments,

market volatility,

Planning,

Stock Market

Cut through the noise with our Financial News Breakdown

Read More

Topics:

Financial Planning,

Investments,

Planning,

saving and investing

Social Media - Whether you hate it or use it daily - it can tell us a lot about the companies we are watching now.

Read More

Topics:

Financial Planning,

Investments,

Planning,

saving and investing

Critical Topics

Financial & Economic Items We're Tracking Now!

Of course, no single investor ever knows with absolute certainty where markets and the economy are heading, but learning how to analyze various information points is critical to long-term success as an investor. In this week’s flash briefing we will dive into the top four items we are tracking in an effort to further provide clarity to where markets and the economy may be heading.

Read More

Topics:

Financial Planning,

Investments,

Planning,

saving and investing