Now that you’ve had a glimpse at our process for bringing in new investments, it is time to look at a more continuous investing responsibility of our firm: managing our current portfolios. This involves using the various investing actions that can be taken to continuously update and tweak our current holdings. This helps to ensure that our models reflect the current markets and maintain our goal of outperformance. Let’s take a look at these options:

Buy

A buy action is to purchase an investment. Our firm buys when the price of the investment is lower but expected to rebound soon after. This helps keep the cost low, allowing our clients’ accounts to purchase more shares, and potentially increase the clients’ gains.

Sell

This action is to sell an investment we currently hold. We sell an investment when it is no longer providing the performance that we originally purchased it for. Creekmur Wealth Advisors sell when the price is higher but expected to decrease soon after. This helps our clients to capitalize on those gains from a price elevation.

Hold

A hold action is to literally hold on to an investment. Holding is owning the investment and not selling it. This is the action that we take when the selling requirement is not fulfilled: the price is not high and expected to drop. Many of our models contain buy and hold investments: more on that later in this article.

Watch

This is not a technical term in investing, but it is one that we at Creekmur Wealth Advisors utilize frequently. Investments that don’t quite make the cut in our filtering, that are too new, or that are too uncertain for the current market conditions are placed on our ‘watchlist.’ This list is reviewed by our analysts at times when the market is changing, and we are looking to adapt to it. This allows us to quickly find different investments to utilize when a market change has occurred.

A Word on Combinations

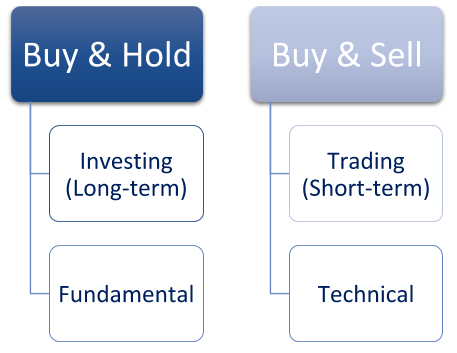

Combinations in this sense refers to combining various actions into a sequence. The two most common combinations are buy & hold and buy & sell. These two sequences reflect the schools of thought that most frequently use them. Below is a graphic that further explains these two:

Of these two sequential actions, our firm focuses on finding investments that fit the buy & hold philosophy: long term outperformers, with potentially consistent and solid growth. Although our firm can participate in trading—buying & selling—it is not our primary concern.

Wrapping Up

Overall, it is important to use all the investing actions when managing a portfolio. These options keep our firm in constant review: looking at new investments as well as current holdings. We utilize these actions to help ensure our clients have a solid foundation from which to build their True Wealth. Please feel free to contact Creekmur Wealth Advisors with any questions!

Securities offered only by duly registered individuals through Madison Avenue Securities, LLC (MAS), member of FINRA/SIPC. Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM), a Registered Investment Adviser. MAS and Creekmur Wealth Advisors are not affiliated entities. AEWM and Creekmur Wealth Advisors are not affiliated entities. Investing involves risk, including the potential loss of principal. This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation.00189667