Does Investor Behavior Impact the Stock Market?

Earning and then saving enough funds to invest is the first & most difficult step to growing wealth & achieving your financial goals. But, after investing your hard-earned money, it is crucial to continue learning how your actions and emotions effect your potential returns. Over the years of working with individual investors we have found that emotions and biases can cloud one’s ability to make well-balanced investment decisions. In recent months we have seen the impact of emotion driven decisions, rather than thoughtful, goals-based decisions. With that in mind here are two "rules" that we would encourage you to follow with your investment decisions.

- Do Not Buy or Sell Investments Based Upon Fear

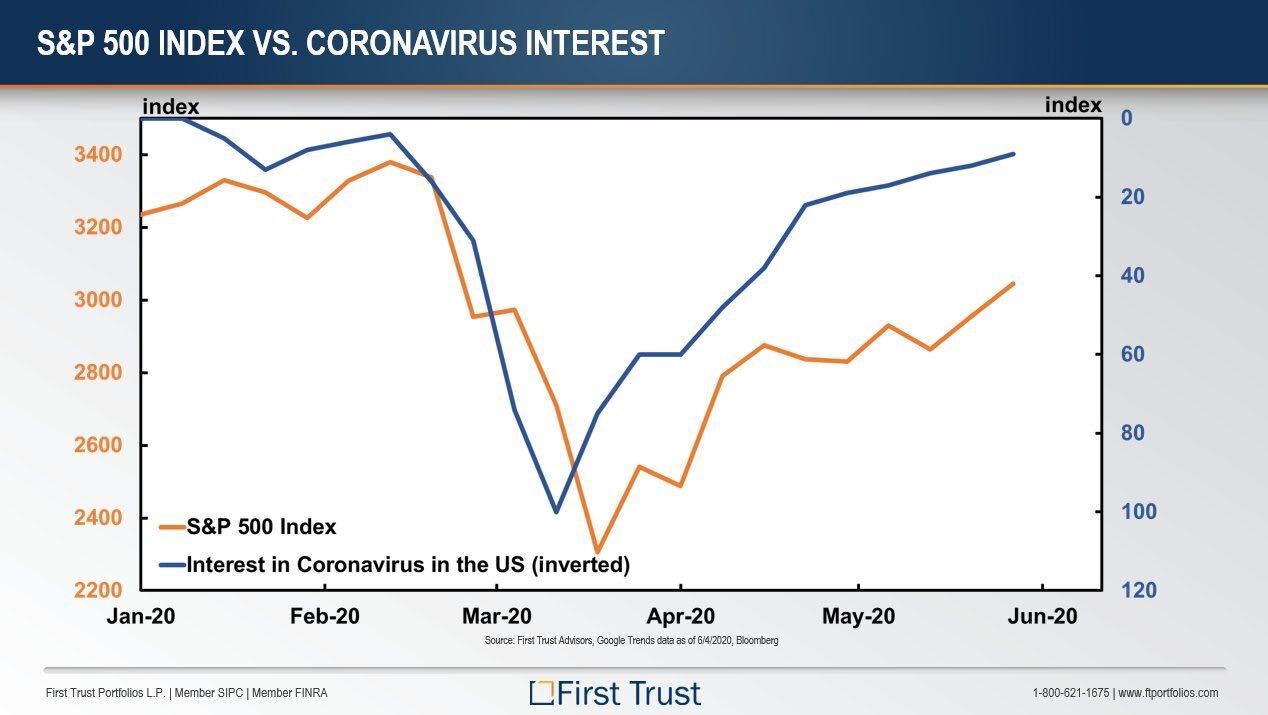

As internet searches for coronavirus peaked, the stock market bottomed. As interest in the virus lagged and switched to other areas, markets began to move higher as illustrated here:

As investors this tells us that, in part, the stock market was being driven by the uncertainty (fear) that COVID-19 created in our country. As more data and a clearer path forward started to come to the surface, investors were able to make less fearful hypothetical projections as to where the economy may be headed. Whenever fear and uncertainty are at all time highs, it is critical that you have a clearly defined investment structure to lean back on. This is one way to ensure that you avoid allowing the emotion of the day impact your decisions negatively.

2. Make Investment Decisions Based on History & Data

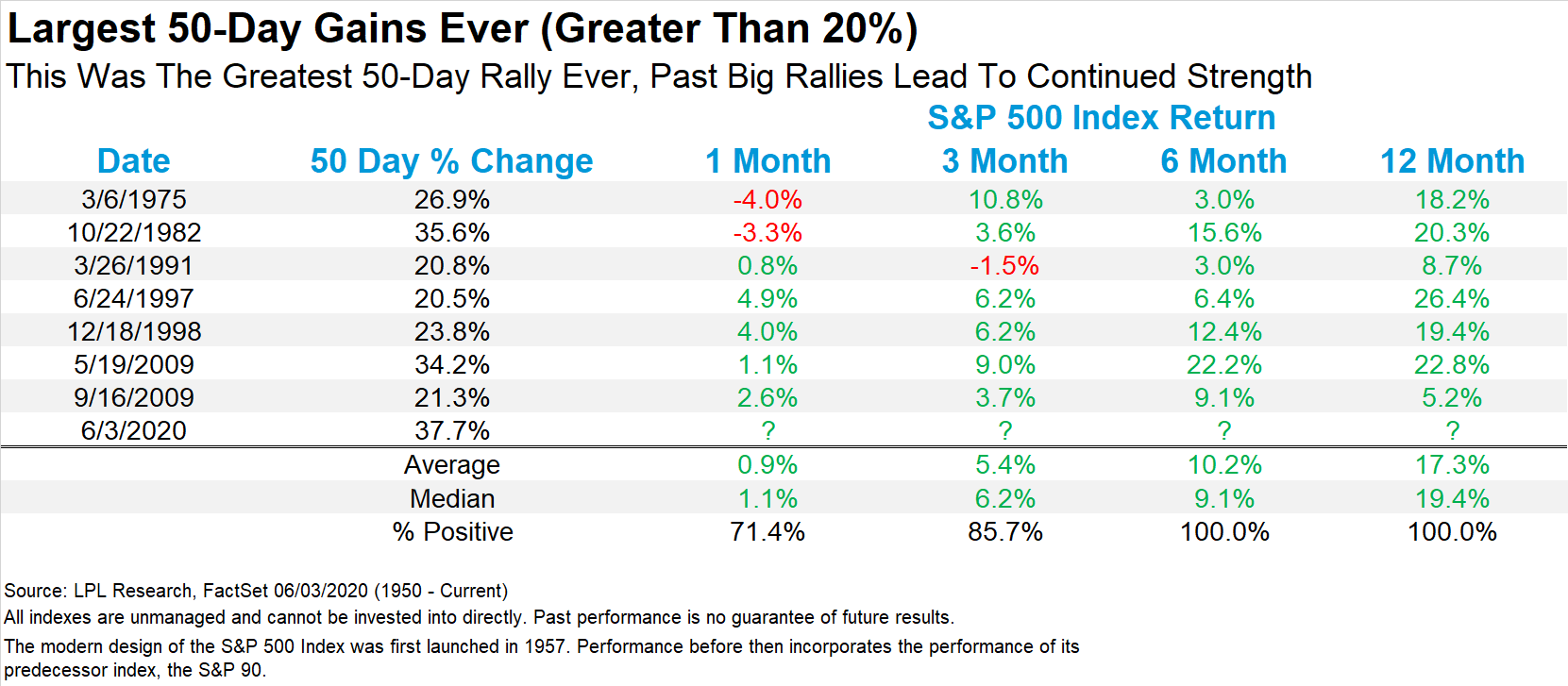

Anyone who switches on cable news or scrolls through a social media feed knows that sensational headlines and conversation is driving all forms of news today. It is so incredibly hard to not allow individuals, with impressive titles and track records of success, to influence your mindset as an investor. For example, I have listened to recent interviews with and read articles written by some of the largest investment managers in the world which predicted a massive stock market meltdown in the “near future” because stocks are “way overvalued” or have “increased too much”. Many of these statements are based on the fact that the S&P 500 just experienced the largest 50-Day Gain in history. When reading or listening to professional asset managers it may make sense to react to what they are saying and sell all your current investments, but how can you confirm that this individual is correct in this situation?

Before reacting to any expert predictions, we always look at the current and historical data to determine if there is any credence to the recommendation being made. What can we learn from history in our current market situation?

As we all know the past performance of the stock market is no indicator of future performance. However, history can be a map to help us clarify the direction things may go in our current day.

In addition to events of the past, we also track data from current trends. Based on recent economic data, we might conclude that the market could move higher in months to come. For example – Airbnb saw a surge in their bookings in the past couple of weeks. And we are seeing that Stocks Continue to Rise as Hope For Stimulus Grows.

The primary takeaway from this topic is that when listening to news sources, we need to realize that the primary purpose of news is to entice viewership. And even experts can have an agenda or personal perspective that they base their thoughts upon. As investors we need to be careful to sift through the potential bias and sensational news stories as we make investment decisions.

Don't let fear or the trending news of the day deter you from the investment plan that was built to accomplish your personal goals. Sometimes adjustments are needed, but be sure they are reinforced by the road map of history and validated by current data.

You have worked too hard to accumulate the funds you have invested for your long-term goals to allow emotional decisions and the opinions of others to derail you. When you see headlines proclaiming huge stock market swings or a hedge fund manager forcefully speaking on a topic, take a step back and think.

- Think about the plan you built when your emotion was in check.

- Review what has happened in past periods of similar economic or market history.

- Consider relevant data to determine the likeliest outcome going forward.

Creekmur Wealth Advisors may be reached at 866-358-4441 or Info@Creekmurwealth.com.

Citations.

1 - https://lplresearch.com/2020/06/04/best-50-day-rally-ever/