Today we’ll be looking into variable annuities. Variable annuities first appeared in the 1950’s as a way to help combat spending power loss in fixed annuities. Today, they are still used—for the same reason! Let’s dive in!

How Variable Annuities Work

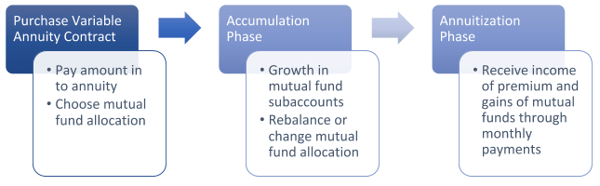

Variable annuities are created the same way as all annuity contracts: putting in a certain amount of money, or premium, and receiving payments from the insurance company in return. However, that’s where the similarities end.

Variable annuities take your premium and invest it into professionally managed subaccounts. These subaccounts are similar to mutual funds. You choose which subaccounts to invest in and can also choose to put some of your premium into a fixed account. A fixed account guarantees a rate of return, although usually rather low, on the amount that is in this account.

After accumulating for a period of time, you enter the annuitization phase and are given payments from the amount of principal plus any gains you received from the subaccounts. However, many people never annuitize, instead taking the maximum withdrawal amount out each year. Variable annuities are structured to help maximize your potential return on your annuity, but that comes with risk.

Variable Annuity Process

Risks of Variable Annuities

Variable annuities have greater risk than other annuities, because they have the most market exposure. With these annuities, you can gain more than a guaranteed rate of return, but you can also lose principal. Market downturns may create losses on your original investment, causing a potential decrease in your future income.

Also, because the guarantees and protections provided by annuities are backed by the financial strength and claims-paying ability of the issuing insurance company, buyers may wish to do some research about the insurance company that is providing the annuity before making a purchase. To inquire about the insurance company, you may contact the insurance company or your state insurance department. Be sure to choose your insurance company wisely when purchasing an annuity contract.

Benefits of Variable Annuities

These annuities have the potential to outpace inflation and increase your spending power. They also have the potential to outperform fixed annuities’ guaranteed interest rates. Having the fixed account portion of a variable annuity provides you with a more stable return. Variable annuities are tax-deferred, so you will not pay taxes on any gains until you withdraw the money.

Additional Considerations of Variable Annuities

Despite these benefits, there are other factors that make variable annuities less appealing. Variable annuities can be expensive, because the subaccounts you choose are professionally managed, meaning you have to pay a management fee. Additionally, with the added potential to outperform, there is always the potential to underperform. Variable annuities do not automatically guarantee a return of premium—you have to pay for that security through an income rider. Again, there’s always the risk of company failure as well. An important risk to consider is the possibility of losing your original investment unless you opt to purchase a rider to help protect it.

Closing Up Variable Annuities

Variable annuities have potential to be good investments for those who are averse to losing spending power. However, there are many risks that come with that potential to outpace inflation, and an investor must weigh those risks against the possible return. Be sure to examine a variable annuity contract very carefully and request a full prospectus review on it. This will give you information on fees, fund performance, and terms of the annuity contract. Take your time looking over it. You can always contact Creekmur Wealth Advisors with any questions!

This is provided for informational purposes only and is not intended to provide specific tax advice or serve as the basis for any financial decisions. Be sure to speak with qualified professionals before making any decisions about your personal situation. Please note that the information included herein from third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed.

Securities and advisory services offered only by duly registered individuals through Madison Avenue Securities, LLC (MAS), member of FINRA/SIPC. Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM), a Registered Investment Adviser. MAS and Creekmur Wealth Advisors are not affiliated entities. AEWM and Creekmur Wealth Advisors are not affiliated entities. Investing involves risk, including the potential loss of principal 00189678